straight life policy cash value

If friends or family members have advised you to look into straight life you will. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

What Is Single Premium Life Insurance The Pros And Cons Valuepenguin

Universal life insurance policies have an option for beneficiaries to receive both the cash value and death benefit.

. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further. While a life insurance policy isnt considered an investment in and of itself its a. Because the cash value is 5000 the real liability cost to the insurance company is 20000 25000 5000.

What you need to know is that in todays terminology straight life insurance is the same as whole life insurance. The premium for a straight life policy is fixed and does not increase with age. 5-Year Term 6580 per year 10-Year Term 7030 per year Straight Life.

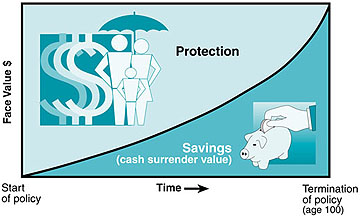

Straight life insurance is a type of permanent life insurance that includes a cash value account that grows over the policys life. This cash value provides a living benefit you can access while youre alive. The term straight life insurance is no longer used in the insurance industry but it pops up occasionally when people talk about life insurance.

Benefits Of A Straight Life Policy 1. A policy loan allows you to borrow from the cash value of your straight life policy. Cash value life insurance is a type of life insurance that combines the savings component of permanent life.

What type of premium does a straight life policy have. Which statement is NOT true regarding a. Also known as whole life insurance a straight life policy has a cash.

It has the lowest. Whole Life Cash Value Accumulation for a 100000 Policy. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

This cash value component typically earns interest or other investment gains and grows tax-deferred. The face value of the policy is paid to the insured at age. Another asset of a straight life policy is a cash value account.

Cash value life insurance is a policy that contains a cash value account. Whole life variable life and universal life insurance are all examples of cash. Whole life insurance cash value grows throughout the life of your policy.

This is a straight life annuity that starts paying you back as. The Insurance Policy Loan. Also known as whole life insurance a straight life policy has a cash.

The face value of the policy is paid to the insured at age 100B. Death Benefit 5 40 1178 3738. Straight refers to the.

Rather than being seized as a collection measure on defaulted loans the cash value in your straight life policy can be leveraged to repay any creditors you owe. 100370 10 45 1178 11569. When you pass away your beneficiary typically receives only the death benefit.

The face value of the policy is paid to the insured at age 100. It covers your life for a chosen period of time. The face value of the policy is paid to the.

In most states the cash value in your policy is protected from garnishments and seizure that might otherwise be incurred from legal judgements. 4 rows Straight life has guaranteed minimum growth potential in the cash value account which can. Permanent policies designed to develop cash value probably have no value if they are newer.

Also known as whole life insurance a straight life policy has a cash. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. 101513 20 55 1178 33838.

A straight life insurance policy can also build cash value over time.

Cash Value Life Insurance Is It Right For You Nerdwallet

Is Cash Value Part Of The Death Benefit Infographic Fig Marketing

How To Get Cash From Your Life Insurance Policy Nerdwallet

The Visible Policy Pg 3 Let The Future Begin

Life Insurance Compare Policies Free Quotes Policygenius

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

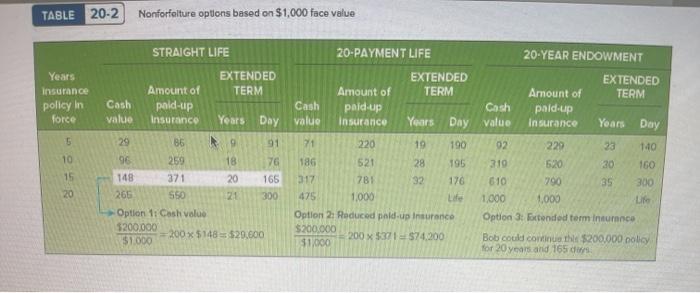

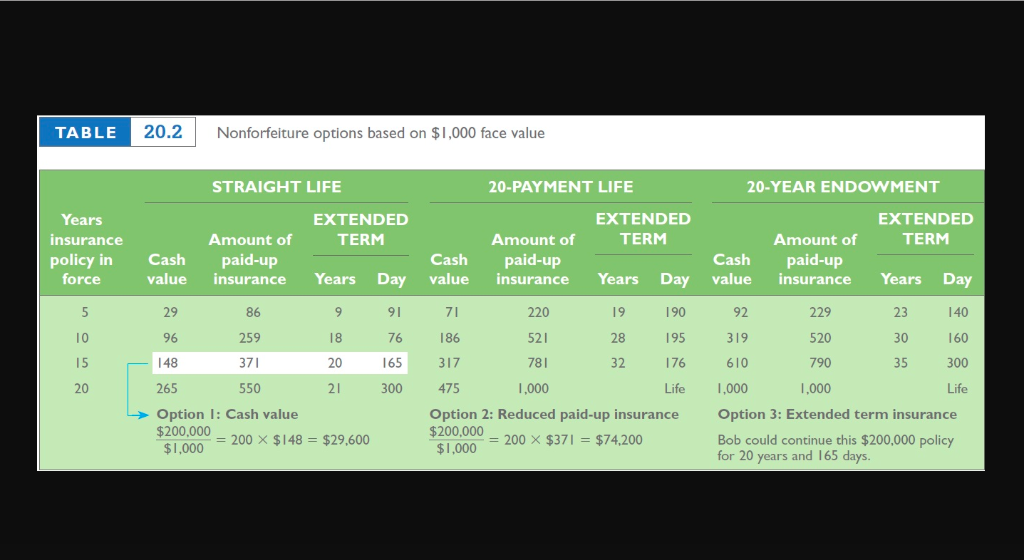

Bus 141 Chapter 20 Flashcards Quizlet

Solved Calculate The Cash Surrender Value For Lee Chin Age Chegg Com

Matt Miller Age 28 Takes Out 50 000 Of Straight Life Insurance His Annual Premium Is 418 20 Brainly Com

Synonyms For Whole Life Insurance Thesaurus Net

Annuity Payout Options Immediate Vs Deferred Annuities

Solved Calculate The Cash Surrender Value For Lee Chin Age Chegg Com

/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

The Complete Resource For Straight Whole Life Insurance

Life Insurance Purposes And Basic Policies Mu Extension

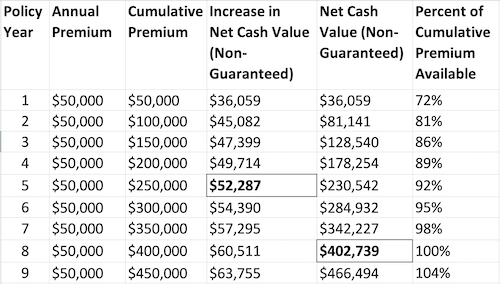

High Cash Value Life Insurance And Long Term Growth Whole Life

)